Some Known Questions About San Diego Home Insurance.

Some Known Questions About San Diego Home Insurance.

Blog Article

Safeguard Your Home and Liked Ones With Affordable Home Insurance Policy Plans

Relevance of Affordable Home Insurance Policy

Securing economical home insurance coverage is important for securing one's home and financial well-being. Home insurance coverage supplies protection versus numerous dangers such as fire, theft, natural disasters, and individual responsibility. By having a detailed insurance strategy in area, home owners can relax ensured that their most substantial investment is safeguarded in case of unpredicted situations.

Cost effective home insurance coverage not only gives financial safety and security but additionally provides satisfaction (San Diego Home Insurance). When faced with climbing building values and building and construction expenses, having a cost-effective insurance coverage policy makes sure that property owners can easily reconstruct or fix their homes without facing substantial financial problems

Furthermore, economical home insurance policy can likewise cover individual belongings within the home, offering compensation for items damaged or swiped. This insurance coverage expands past the physical structure of your home, safeguarding the components that make a house a home.

Coverage Options and Boundaries

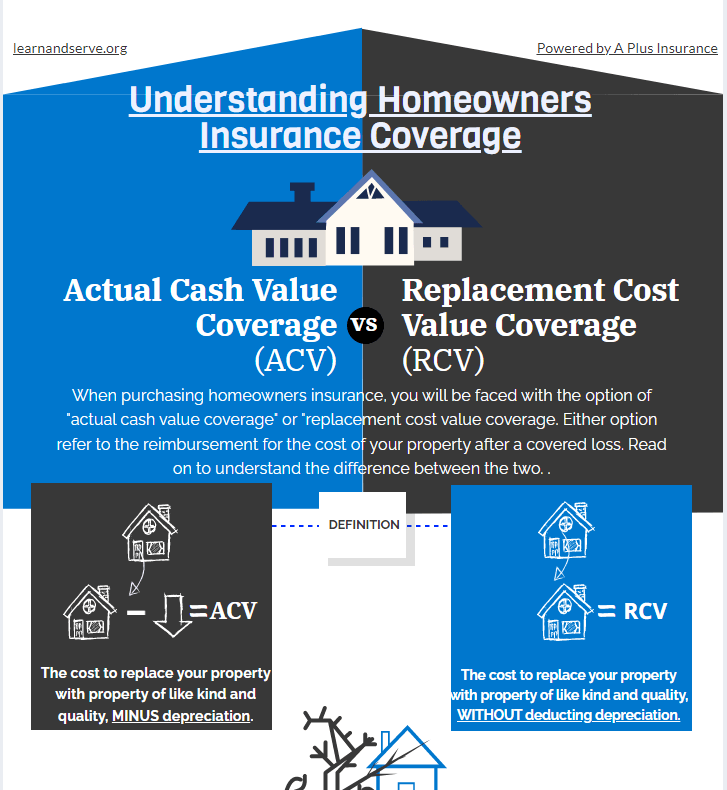

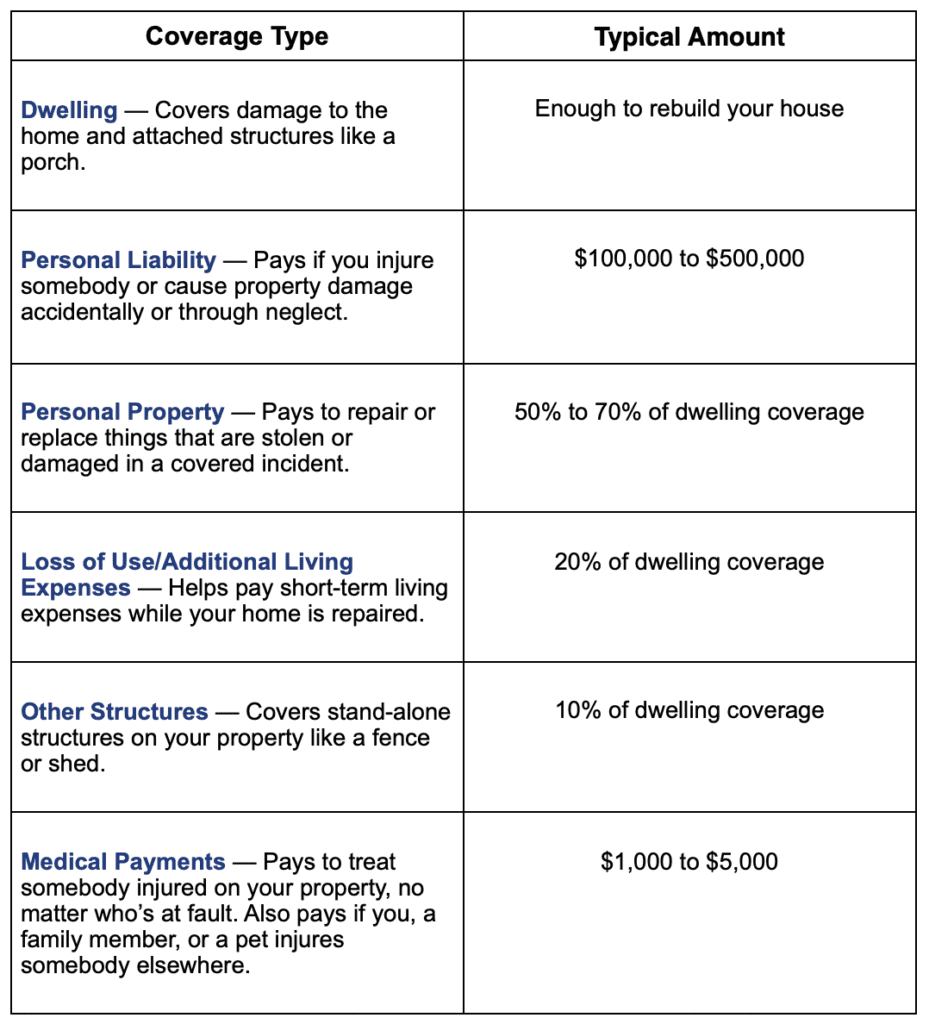

When it pertains to insurance coverage limitations, it's important to recognize the maximum amount your plan will certainly pay out for every kind of protection. These restrictions can differ relying on the plan and insurance provider, so it's important to review them carefully to ensure you have ample security for your home and possessions. By recognizing the coverage alternatives and limitations of your home insurance plan, you can make informed decisions to guard your home and loved ones successfully.

Variables Influencing Insurance Coverage Costs

Several variables considerably affect the prices of home insurance policies. The place of your home plays a crucial role in figuring out the insurance policy costs. Residences in areas susceptible to all-natural catastrophes or with high crime rates generally have greater insurance policy expenses as a result of boosted dangers. The age and condition of your home are likewise elements that insurance firms consider. Older homes or residential properties in poor condition might be extra pricey to insure as they are more susceptible to damages.

In addition, the kind of coverage you select straight influences the price of your insurance coverage policy. Opting for added protection alternatives such as flood insurance coverage or quake protection will certainly boost your costs.

Furthermore, your debt rating, declares background, and the insurer you choose can all affect the cost of your home insurance plan. By thinking about these aspects, you can make informed decisions to assist manage your insurance sets you back properly.

Contrasting Providers and quotes

In enhancement to contrasting quotes, it is important to assess the reputation and monetary stability of the insurance policy providers. Look for client reviews, ratings from independent agencies, and any type of history of complaints or regulatory activities. A dependable insurance coverage copyright should have a great track record of without delay refining claims and providing exceptional customer support.

In addition, consider the specific coverage features used by each copyright. Some insurance providers might offer added advantages such as identity theft protection, tools malfunction coverage, or insurance coverage for original site high-value products. By meticulously contrasting carriers and quotes, you can make an educated choice and select the home insurance coverage strategy that best meets your demands.

Tips for Saving Money On Home Insurance Coverage

After thoroughly comparing quotes and service providers to discover the most suitable insurance coverage for your requirements and budget plan, it is sensible to explore efficient approaches for conserving on home insurance. One of the most significant methods to minimize home insurance is by bundling your plans. Many insurance policy firms offer discounts if you acquire multiple policies from them, such as combining your home and vehicle insurance. Boosting your home's safety steps can likewise lead to savings. Installing safety and security systems, smoke alarm, deadbolts, or an automatic sprinkler can reduce the threat of damages or theft, possibly reducing your insurance policy costs. In addition, maintaining an excellent credit history can positively affect your home insurance coverage rates. Insurance firms often take into consideration credit rating history when identifying costs, so paying costs in a timely manner and handling your credit properly can result in lower insurance policy costs. Last but not least, routinely assessing and updating your plan to show any kind of changes in your home or situations can ensure you are not spending for protection you no longer demand, helping you More Bonuses save cash on your home insurance costs.

Verdict

In verdict, protecting your home and enjoyed ones with budget-friendly home insurance coverage is vital. Executing tips for conserving on home insurance coverage can additionally aid you secure the essential defense for your home without breaking the bank.

By deciphering the complexities of home insurance policy strategies and exploring functional techniques for protecting affordable coverage, you can ensure that your home and liked ones are well-protected.

Home insurance coverage plans typically offer several protection choices to secure your home and items - San Diego Home Insurance. By comprehending the insurance coverage choices and restrictions of your home insurance plan, you can make enlightened decisions to secure your home and loved ones effectively

Frequently evaluating and upgrading your plan to show any kind of adjustments in your home or scenarios can ensure you are not paying for coverage you no longer requirement, helping you save money on your home insurance premiums.

In verdict, guarding your home and enjoyed ones with affordable home insurance is vital.

Report this page